Importing a car from the US to Canada can be an exciting venture, offering you the opportunity to acquire a vehicle that might not be available in the Canadian market. However, the process involves going through a set of regulations, paperwork, and logistical considerations. In this comprehensive guide, we’ll walk you through the step-by-step process of importing a car from the US to Canada, ensuring a smooth transition for your dream vehicle.

Research and Preparation

Do your research before importing a vehicle from US into Canada. Identify the specific vehicle you want to import and confirm its eligibility with the Registrar of Imported Vehicles (RIV) database. Check for compliance with Canadian safety and emission standards.

Compliance with Canadian Standards:

If your chosen vehicle doesn’t comply with Canadian standards, you may need to make modifications to it before it can be legally imported. These modifications can be expensive and time-consuming, so it’s important to factor them into your decision to import a vehicle.

A licensed mechanic can help you determine if your vehicle complies with Canadian standards and can advise you on any required modifications. They can also help you obtain the necessary documentation and permits for importing the vehicle.

Here are some of the common modifications that may be required to import a vehicle to Canada:

- Installing a catalytic converter to reduce emissions

- Adding daytime running lights

- Installing seatbelts in all seating positions

- Replacing non-compliant tires

- Modifying the headlights to meet Canadian standards

It’s important to note that the specific modifications required will vary depending on the vehicle and the year it was manufactured. You should always consult with a licensed mechanic to determine the specific requirements for your vehicle.

Verify Vehicle History

It is important to verify the vehicle history before importing a car to Canada. This will help you ensure that the car doesn’t have a salvaged title, reported accidents, or other issues that could affect its value or reliability.

There are a number of companies that offer vehicle history reports. Some of the most popular include:

- CARFAX

- AutoCheck

- VIN Verify

- Carfax Canada

- VIN Audit Canada

These companies typically charge a fee for their reports, but they can be a valuable investment to protect yourself from buying a lemon.

When choosing a vehicle history report, it’s important to select one that provides the most comprehensive information. Some reports only include basic information, such as the vehicle’s make, model, and year. Others include more detailed information, such as the vehicle’s accident history, odometer readings, and service records.

It’s also important to make sure that the vehicle history report is from a reputable company. Some companies sell fake or inaccurate vehicle history reports.

Once you have obtained a vehicle history report, carefully review it for any red flags. These red flags could include:

- A salvaged title

- Reported accidents

- A history of odometer tampering

- A history of service problems

If you see any red flags, it’s best to avoid buying the car. A salvaged title means that the car has been totaled and rebuilt. This could affect the car’s value and reliability. Reported accidents could also affect the car’s value and reliability. Odometer tampering could mean that the car has been driven more miles than it shows. A history of service problems could mean that the car is prone to problems.

Calculate Duties and Taxes

The Canada Border Services Agency (CBSA) website has a duty calculator that you can use to estimate the amount of duties and taxes you will need to pay. You will need to provide the make, model, year, and value of the car, as well as its country of origin and fuel type.

In addition to duties and taxes, you may also need to pay an excise tax. The excise tax is a tax on certain goods, such as alcohol, tobacco, and gasoline. The excise tax for cars is $100.00 CAD.

You will also need to pay the Goods and Services Tax (GST) or Harmonized Sales Tax (HST). The GST is a federal tax of 5%. The HST is a combined federal and provincial tax of 15%. The HST is applied in the provinces of Ontario, New Brunswick, Nova Scotia, and Newfoundland and Labrador.

The total amount of duties, taxes, and fees you will need to pay will depend on the specific circumstances of your import. It is important to calculate these costs carefully before you import a car to Canada.

Here are some additional tips for calculating the applicable duties and taxes:

- Use the CBSA duty calculator to get an estimate of the number of duties and taxes you will need to pay.

- Be sure to include the value of the car, its country of origin, and its fuel type when using the calculator.

- Check with the CBSA for the latest rates and regulations.

- Be sure to factor in the cost of any other fees, such as the excise tax and the GST or HST.

Complete Necessary Paperwork

The required paperwork will vary depending on the circumstances of your import, but it will typically include the following:

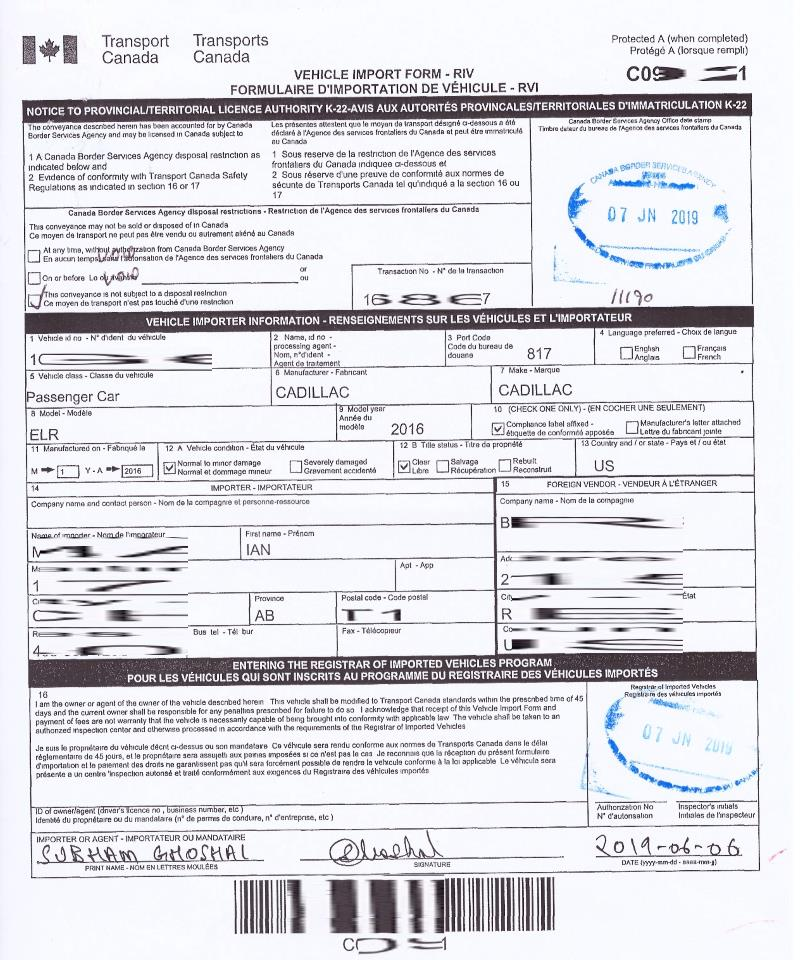

- Vehicle Import Form (Form 1)

- Bill of Sale

- Proof of Ownership

- Clear Title

- Insurance

- Recall Clearance Letter

- Vehicle Identification Number (VIN) Verification Letter

The Vehicle Import Form (Form 1) is the most important document. It is used to declare the vehicle to the Canada Border Services Agency (CBSA). You can find the form on the CBSA website.

The Bill of Sale is a document that shows that you have purchased the vehicle. It should be signed by both the seller and the buyer.

Proof of Ownership is a document that shows that you are the legal owner of the vehicle. This could be a copy of the title, registration, or insurance card.

A Clear Title is a document that shows that the vehicle has no liens or encumbrances. This means that you are the sole owner of the vehicle and that there are no outstanding debts against it.

Insurance is required for all vehicles imported to Canada. You will need to provide proof of insurance to the CBSA when you import the vehicle.

A Recall Clearance Letter is a document that shows that the vehicle has been recalled and that the necessary repairs have been made. This is required for all vehicles that have been recalled in the United States or Canada.

A Vehicle Identification Number (VIN) Verification Letter is a document that confirms the VIN of the vehicle. This is required for all vehicles imported to Canada.

You can find the specific requirements for importing a car to Canada on the CBSA website. It is important to read the requirements carefully and to make sure that you have all of the necessary paperwork before you import the vehicle.

Transport and Customs Clearance

There are many different companies that offer vehicle transport services, so it is important to do your research and choose a company that has a good reputation.

When choosing a vehicle transport service, it is important to consider the following factors:

- The company’s experience transporting vehicles to Canada.

- The company’s rates.

- The company’s insurance coverage.

- The company’s customer service.

It is also important to get quotes from multiple companies before making a decision.

Once you have chosen a vehicle transport service, they will need to know the following information:

- The make, model, and year of the vehicle.

- The vehicle’s VIN.

- The vehicle’s weight.

- The vehicle’s destination in Canada.

The vehicle transport service will then schedule the vehicle to be picked up and transported to Canada.

When the vehicle arrives at the border, you will need to present the following paperwork to the Canada Border Services Agency (CBSA):

- Vehicle Import Form (Form 1)

- Bill of Sale

- Proof of Ownership

- Clear Title

- Insurance

- Recall Clearance Letter

- Vehicle Identification Number (VIN) Verification Letter

The CBSA officer will inspect the vehicle and may ask you questions about it. Once the vehicle has been cleared by the CBSA, you will be able to drive it into Canada.

Here are some additional tips for transporting and clearing your car through customs:

- Book your vehicle transport service well in advance, especially if you are importing the car during peak season.

- Make sure the vehicle transport company is familiar with the import requirements for Canada.

- Be prepared to pay the applicable taxes and duties.

- Be patient and polite when dealing with the CBSA officers.

RIV Registration

It is important to register your car with the Registrar of Imported Vehicles (RIV) after clearing customs. The RIV is a government agency that regulates the importation of vehicles into Canada.

To register your car with the RIV, you will need to pay a registration fee and provide the following documentation:

- Vehicle Import Form (Form 1)

- Bill of Sale

- Proof of Ownership

- Clear Title

- Insurance

- Recall Clearance Letter

- Vehicle Identification Number (VIN) Verification Letter

You can register your car with the RIV online or by mail. The RIV website has a step-by-step guide on how to register your car.

Once your car has been registered with the RIV, you will receive a Vehicle Import Form (Form 1). This form is required for Canadian vehicle registration. You can then take the form to your provincial or territorial motor vehicle licensing office to register your car.

Vehicle Insurance

Insurance is required by law for all vehicles driven on Canadian roads.

The type of insurance coverage you need will depend on your individual circumstances. However, you should at least have the following:

- Liability insurance: This covers the cost of damage to other vehicles and property if you are at fault in an accident.

- Collision insurance: This covers the cost of damage to your own vehicle if you are at fault in an accident.

- Comprehensive insurance: This covers the cost of damage to your own vehicle, regardless of who is at fault in an accident.

It is also a good idea to consider adding additional coverage, such as:

- Rental car reimbursement: This will cover the cost of renting a car if yours is damaged in an accident.

- Medical payments: This will cover the cost of medical expenses for you and your passengers if you are injured in an accident.

- Personal injury protection (PIP): This will cover the cost of lost wages and other expenses if you are injured in an accident.

You can shop around for insurance quotes from different companies to find the best rates for your needs. It is important to compare the coverage limits, deductibles, and other terms of the policies before you choose one.

News by 7Motors